In the ever-evolving landscape of digital finance, Cashlib Lastschrift has emerged as a crucial player, offering consumers a seamless and innovative payment solution. As digital transactions become more prevalent, understanding how Cashlib Lastschrift operates and its benefits can enhance the user experience and facilitate smooth financial exchanges.

The digital era has transformed how consumers conduct financial transactions. Traditional payment methods, such as cash and checks, are increasingly being replaced by digital alternatives. This shift has led to the development of various payment solutions, with Cashlib Lastschrift standing out due to its unique features and user-friendly design.

Cashlib Lastschrift is a digital payment method that allows consumers to authorize automatic bank payments directly from their accounts. This service is particularly popular in specific regions for its convenience, security, and efficiency, enabling users to manage their finances more effectively.

To utilize Cashlib Lastschrift, users must first create an account. This process typically involves providing personal information and linking a bank account. Once registered, users can easily initiate payments using this digital solution.

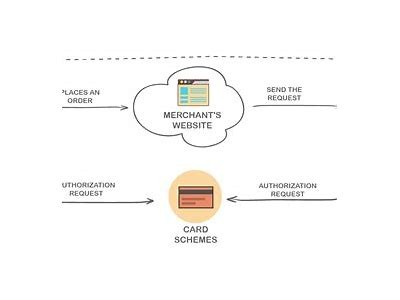

The payment process with Cashlib Lastschrift is simple. When a purchase is made, the user selects the Lastschrift option during checkout. The user then authorizes the payment, allowing the specified amount to be withdrawn from their bank account automatically. This process eliminates the need for manual payment entries and reduces the risk of late payments.

One of the main concerns in digital payments is security. Cashlib Lastschrift employs various security measures, including encryption techniques and secure authorization protocols, to ensure the safety of transactions. Users can trust that their financial information is protected against fraud and unauthorized access. Advantages of Cashlib Lastschrift Convenience

The foremost advantage of Cashlib Lastschrift is convenience. Users can set up recurring payments for subscription services, utility bills, and other regular expenses, simplifying financial management. Cost-Effectiveness

Cashlib Lastschrift often incurs lower fees compared to other payment methods, making it a cost-effective option for both consumers and businesses. This can be particularly advantageous for small businesses looking to minimize operating costs. Time-Saving

Automating payments through Cashlib Lastschrift saves users valuable time. By reducing the need for manual payment processes, individuals can focus on other important aspects of their lives. Challenges and Considerations Limitations

While Cashlib Lastschrift offers many benefits, it is not without limitations. Some users may face issues if their linked bank account does not have sufficient funds at the time of payment, leading to failed transactions. User Awareness

For Cashlib Lastschrift to be effective, users must be informed about the service. Lack of awareness can hinder its adoption, resulting in missed opportunities for both consumers and businesses. Implementing Cashlib Lastschrift in Business Integrating with E-commerce Platforms

Businesses looking to implement Cashlib Lastschrift can easily integrate it with popular e-commerce platforms. This integration ensures a smooth checkout experience for customers, potentially leading to increased sales and customer satisfaction. Marketing Strategies

Effective marketing strategies are essential for promoting Cashlib Lastschrift to potential users. Educating consumers about its benefits and providing incentives for using this payment method can drive adoption rates. Conclusion

Cashlib Lastschrift represents a significant advancement in digital payment solutions. Its convenience, cost-effectiveness, and security features make it an attractive option for both consumers and businesses. As the digital finance landscape continues to evolve, understanding and leveraging solutions like Cashlib Lastschrift will be crucial for staying ahead in an increasingly competitive market.

WillBet: Elevate Your Betting Experience

WillBet: Elevate Your Betting Experience